Home mortgage interest deduction calculator

There are options to include extra payments or annual. They want to know the qualified loan limit and how much of the interest.

Mortgage Calculator Mister Mortgage

This limitation was introduced by the Tax Cuts and Jobs Act TCJA and will revert to 1 million after 2025.

. Bank Has The Tools For Your Mortgage Questions. Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. Please note that if your mortgage closed on or.

The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in mortgage debt while. Use this calculator to see how much you could save.

Ad Calculate Your Payment Fees More with a FHA Home Loan Expert. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. This calculator is for general education purposes only and is not an illustration of.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. This calculator computes your clients qualified mortgage loan limit and the deductible home mortgage interest. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information.

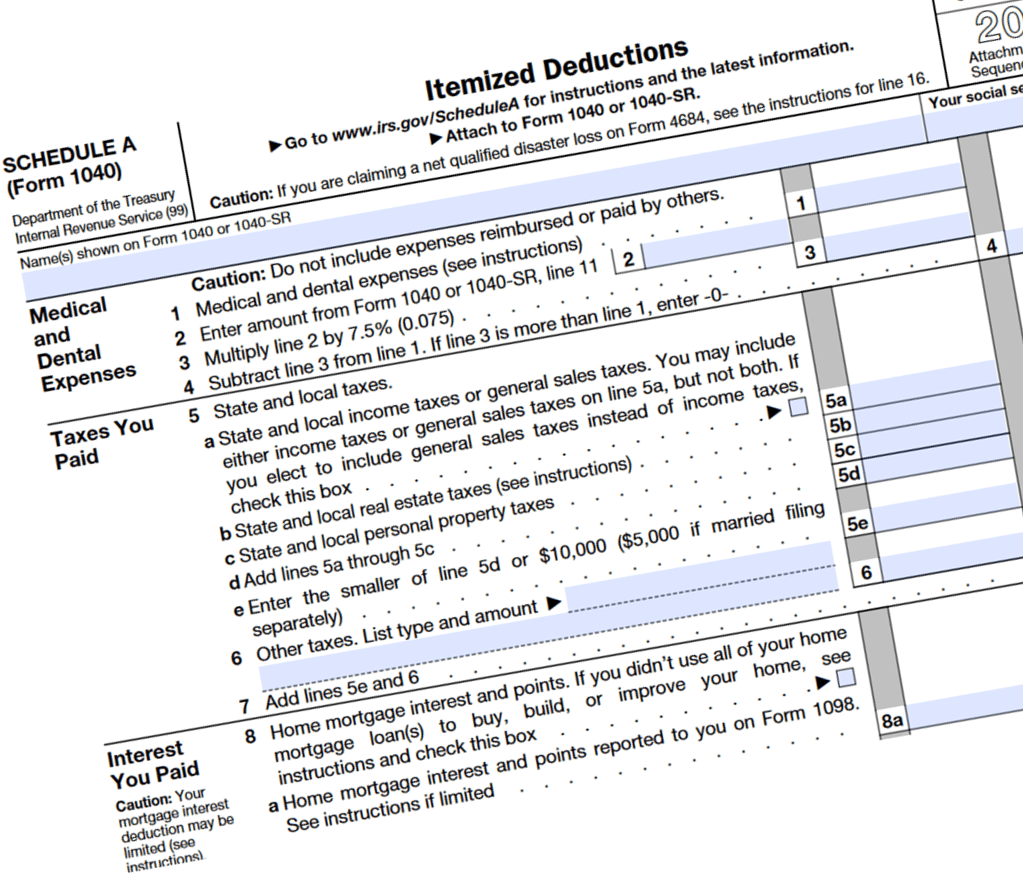

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. How much can the mortgage tax credit give you tax savings. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

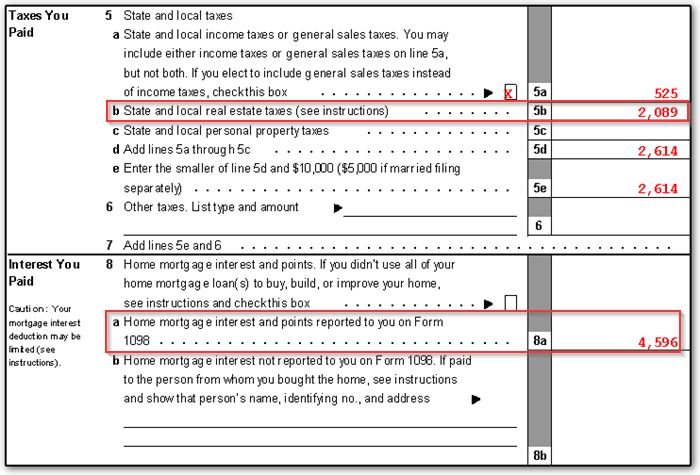

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. This calculator will help you to estimate the tax savings that you will realize due to the deductable interest and property tax payments you will make on your mortgage. This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly or 12400 for.

Standard deduction rates are as follows. In 2021 you took out a 100000 home mortgage loan payable over 20 years. Use this calculator to estimate your potential tax savings.

Here is an example of what will be the scenario to some people. For taxpayers who use married filing separate. Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on either their first or second residence.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Signed in 2017 the Tax Cuts and Jobs Act TCJA changed individual income tax by lowering the mortgage deduction limit and putting a limit on what you can deduct from your. Find out with our online calculator.

12550 for tax year 2021 12950 for tax year 2022. Single taxpayers and married taxpayers who file separate returns. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on your.

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term. 877 948-4077 call Schedule a Call. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

As noted in general you can deduct the mortgage interest you paid during the tax year on the first 1 million of your mortgage debt for your primary home or a second home. See How Much You Can Save with Low Money Down Low Interest Rates. The interest paid on a mortgage.

For those who itemize deductions the mortgage interest on their main home and on a second home may be deductible. Throughout the course of your mortgage the interest on your mortgage. You paid 4800 in points.

IRS Publication 936. The terms of the loan are the same as for other 20-year loans offered in your area.

Mortgage Interest Tax Deduction What Is It How Is It Used

Free Home Office Deduction Worksheet Excel For Taxes

How Does A Refinance In 2021 Affect Your Taxes Hsh Com

Tax Deductions For Home Mortgage Interest Under Tcja

Mortgage Interest Deduction How It Calculate Tax Savings

Free Mortgage Calculator Mn The Ultimate Selection Mortgage Interest Tax Deductions Mortgage Interest Rates

1040 Schedule E Tax Court Method Election

Mortgage Tax Deduction Calculator Freeandclear

Linear Mortgage Abn Amro

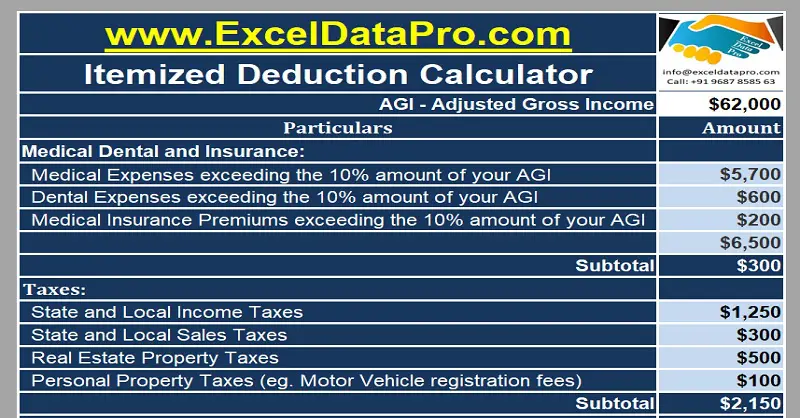

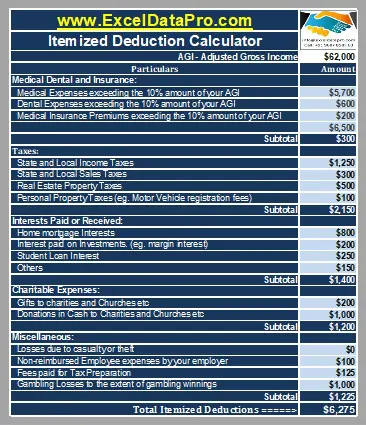

Download Itemized Deductions Calculator Excel Template Exceldatapro

/ScreenShot2021-02-09at12.51.04PM-6f772fddc89f4ef9a4fdb81e432d57d8.png)

Form 8396 Mortgage Interest Credit Definition

Publication 936 Home Mortgage Interest Deduction Part Ii Limits On Home Mortgage Interest Deduction

Tax Deductible Mortgage Interest All You Need To Know Viisi Expats

Download Itemized Deductions Calculator Excel Template Exceldatapro

Mortgage Interest Deduction How It Calculate Tax Savings

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits Deductions Exemptions 2022 23 Youtube

Mortgage Interest Deduction How It Calculate Tax Savings